Younger, credit eligible consumers in Hong Kong offer significant opportunities for lenders; and understanding the credit behaviours and preferences of these emerging consumers and empowering them with adequate access to credit can help lenders better service the needs of this increasingly credit-active generation, according to a recent survey.

Notably, 84% of young adult consumers in Hong Kong agree that credit access is important for achieving their financial goals, while 60% agree that credit will give them access to new opportunities that can lead to a better quality of life, which is a strong indication that younger borrowers understand the importance and relevance of credit access, finds insights firm TransUnion’s Empowering Young Consumers’ Credit Lifecycle study, which set out to examine common perceptions about young consumers, often negative, that persist in the market.

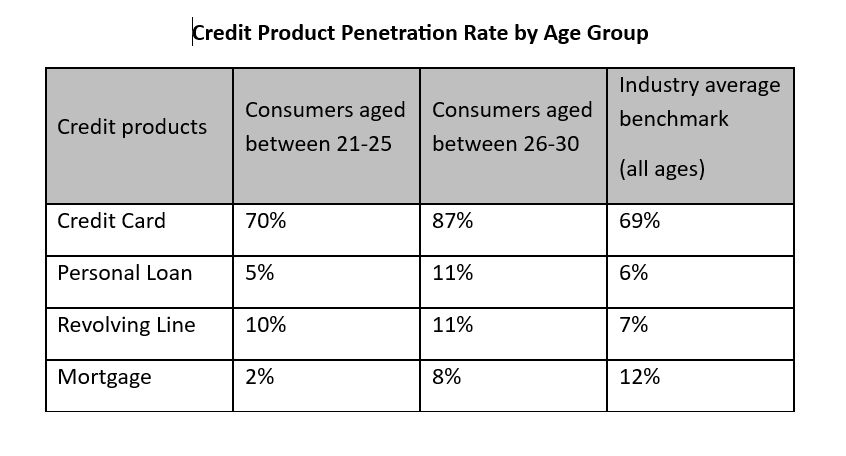

The table below shows that younger consumers actively participated in the credit market over the study period, the survey notes, with the percentage of younger consumers holding unsecured products ( credit cards, personal loans and revolving lines ) exceeding overall industry averages in all products, except personal loans for the 21-to-25 age tier.

Source: TransUnion

However, the fact that 10% or less of younger consumers hold a credit product other than a credit card, the survey points out, indicates opportunities for lenders to grow their portfolios by introducing other credit products to these consumers. As well, the lower participation among younger consumers for mortgages, while not surprising given affordability challenges, indicates further opportunities to expand access to home ownership.

Looking at credit cards, which are the most popular credit product among the young adult consumers in Hong Kong, survey data shows, while credit lines increased with age across all risk tiers, utilization rates remained steady as consumers aged. With higher line access, average balances increased with age, indicating that growing consumption needs and greater credit access are met with responsible borrowing.

Only one in three young adult consumers made any new credit enquiries in a six-month period over 2022 and 2023, with only one in four originating a new credit product over that time, showing that these consumers had a low level of interest in applying for new credit.

Credit cards were the most popular new product among young adults during the study period, the survey shares, with 20% of 21-year-olds originating a new credit card over this period, up to 23% of 25-year-olds opening a card and the same for 30-year-olds. In contrast, fewer than 5% of younger consumers opened a new personal loan, mortgage or revolving line in the period under study.

However, when the time came to apply for an additional credit product, just 3% of young adult borrowers returned to their first lender for a new credit product. This highlights an opportunity for lenders, the survey argues, to bolster their approaches to building customer loyalty, and also suggests that cross-selling strategies may support wallet expansion, especially as consumers’ needs shift with age.

Higher delinquency rates among young adults indicate underperformance compared with consumers in other age groups, the survey reveals, although Hong Kong delinquency rates, even for younger consumers, remain low in comparison with other global markets.

Among 21-year-old prime credit card holders, 1.5% of new accounts opened, the survey calculates, are at 30 days or more past due after 12 months on book. Defaults are lower for slightly older age cohorts, with delinquencies for new accounts after 12 months among 25- and 26-year-old prime consumers at 1%, on par with industry vintages for the prime segment.

These delinquency rates highlight, the survey believes, the importance of financial education, targeted risk mitigation tools and custom credit management strategies to these consumers who are relatively new in their credit journey.

“Enabling younger consumers with adequate credit access empowers them financially, allowing better management of everyday expenses and unforeseen financial obligations,” says Weihan Sun, TransUnion’s principal of research and consulting for Asia-Pacific. “This empowerment is critical for promoting financial inclusivity and aiding these individuals in achieving important life milestones, such as home ownership, studying abroad or entrepreneurship.”