Although 2023 promises to be a more positive year than 2022, investors who are still worried about market uncertainty in the medium to long term are seeking balanced funds.

Before the rate hikes that began in May 2022, balanced funds were less favoured than growth funds because of the low-interest rate environment and the bullish equity markets. The bulk of a balanced fund is usually invested in bonds and it is unlikely to outperform a pure equities fund over a long investment horizon.

“This year people are more directional. Demand for balanced funds is rising and investors are putting more money into balanced funds,” says Andrew Hendry, head of distribution, Asia, at Janus Henderson Investors. “There are more institutional searches for balanced funds. For example, money is being committed to the intermediary market here in Hong Kong. We have three very large private banks that sell our balanced fund and that is their focus this year.”

In recent months, Korean institutional clients have invested substantial amounts in Janus Henderson’s US dollar balanced fund and Taiwanese institutional clients are expressing interest in these funds, the Singapore-based Hendry says in an interview with The Asset during a visit to Hong Kong.

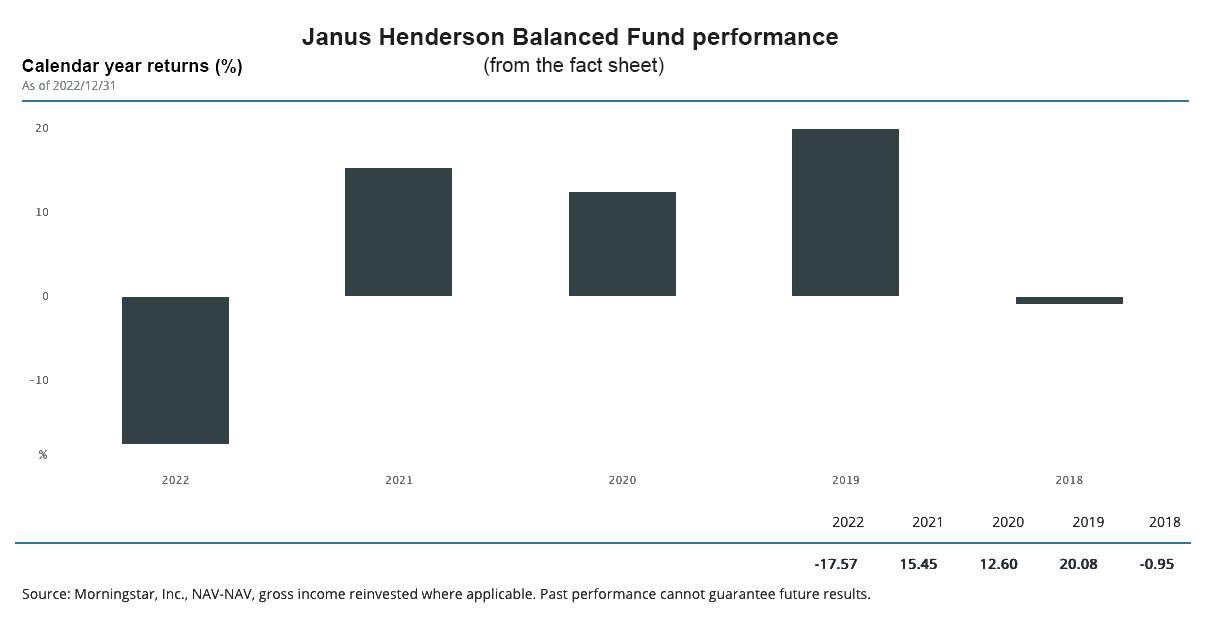

Investor appetite has been increasing, although its balanced fund suffered a negative performance ( -17.57 ) in 2022 after posting positive returns in previous years ( 15.45% in 2021, 12.6% in 2020, and 20.08% in 2019 ). Launched in December 1998, the fund has US$7.04 billion in assets under management as of December 31 2022.

The growing interest in balanced funds has renewed the debate on the merits of the 60-40 asset allocation model where 60% of the balanced portfolio is invested in fixed income and 40% in equities.

“It's very hotly debated right now. We're a little bit schizophrenic because when you talk to our hedge fund guys, they'll say it’s the end of 60-40, it’s ridiculous and 2022 was proof of it. Fixed income and equity were all down. There was nowhere to hide. That's the end of it. Be realistic,” Hendry says.

However, the portfolio managers who run the balanced fund argue that the events that happened in 2022, where the bonds and equity markets were all down, have happened only four times in the last 100 years, in 1969, 1931, 1941, and 2022, Hendry says.

“Four times in 100 years, now you've got to be really unlucky for that. So it depends on which side you want to focus on, and which conversation you're having. Essentially, you need everything in your portfolio for diversification. But it's not the end of 60-40,” he stresses.

Janus Henderson’s AUM dropped by 33.5% to US$287.3 billion as of December 31 2022. About 10% of those assets are from Asia. However, AUM grew 4.6% in Q4 2022. Net outflows totalled US$36.5 billion for the year ended December 31 2022, compared with net outflows of US$16.2 billion in 2021.

Hendry says he expects 2023 to be a positive year compared to 2022, citing the recovery in the equity markets in January. “We’re positive about the prospects for 2023, although the main risk to financial markets is geopolitical developments.”